Chemical Engineering :: Chemical Engineering Plant Economics

-

If the interest rate of 10% per period is compounded half yearly, the actual annual return on the principal will be __________ percent.

-

Which of the following is a component of working capital investment ?

-

'Six-tenth factor' rule is used for estimating the

-

Payback period

-

In an ordinary chemical plant, electrical installation cost may be about

-

Pick out the wrong statement.

-

Personnel working in the market research group is reponsible for the job of

-

"Break-even point" is the point of intersection of

-

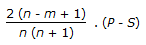

'P' is the investment made on an equipment, 'S' is its salvage value and 'n is the life of the equipment in years. The depreciation for rath year by the sum-of years digit method will be

-

Pick out the wrong statement.

|

A.

Debt-equity ratio of a chemical company describes the lenders contribution for each rupee of owner's contribution i.e., debt-equity ratio = total debt/net worth.

|

|

B.

Return on investment (ROI) is the ratio of profit before interest & tax and capital employed (i.e. net worth + total debt).

|

|

C.

Working capital = current assets + current liability.

|

|

D.

Turn over = opening stock + production closing stock.

|

|

A.

Gross revenue is that total amount of capital received as a result of the sale of goods or service.

|

|

B.

Net revenue is the total profit remaining after deducting all costs excluding taxes.

|

|

C.

The ratio of immediately available cash to the total current liabilities is known as the cash ratio.

|

|

D.

Consolidated income statement based on a given time period indicates surplus capital and shows the relationship among total income, costs & profit over the time interval.

|

Whatsapp

Whatsapp

Facebook

Facebook